Source: https://www.privatedebtinvestor.com/will-uk-pension-reform-help-alternatives-managers/

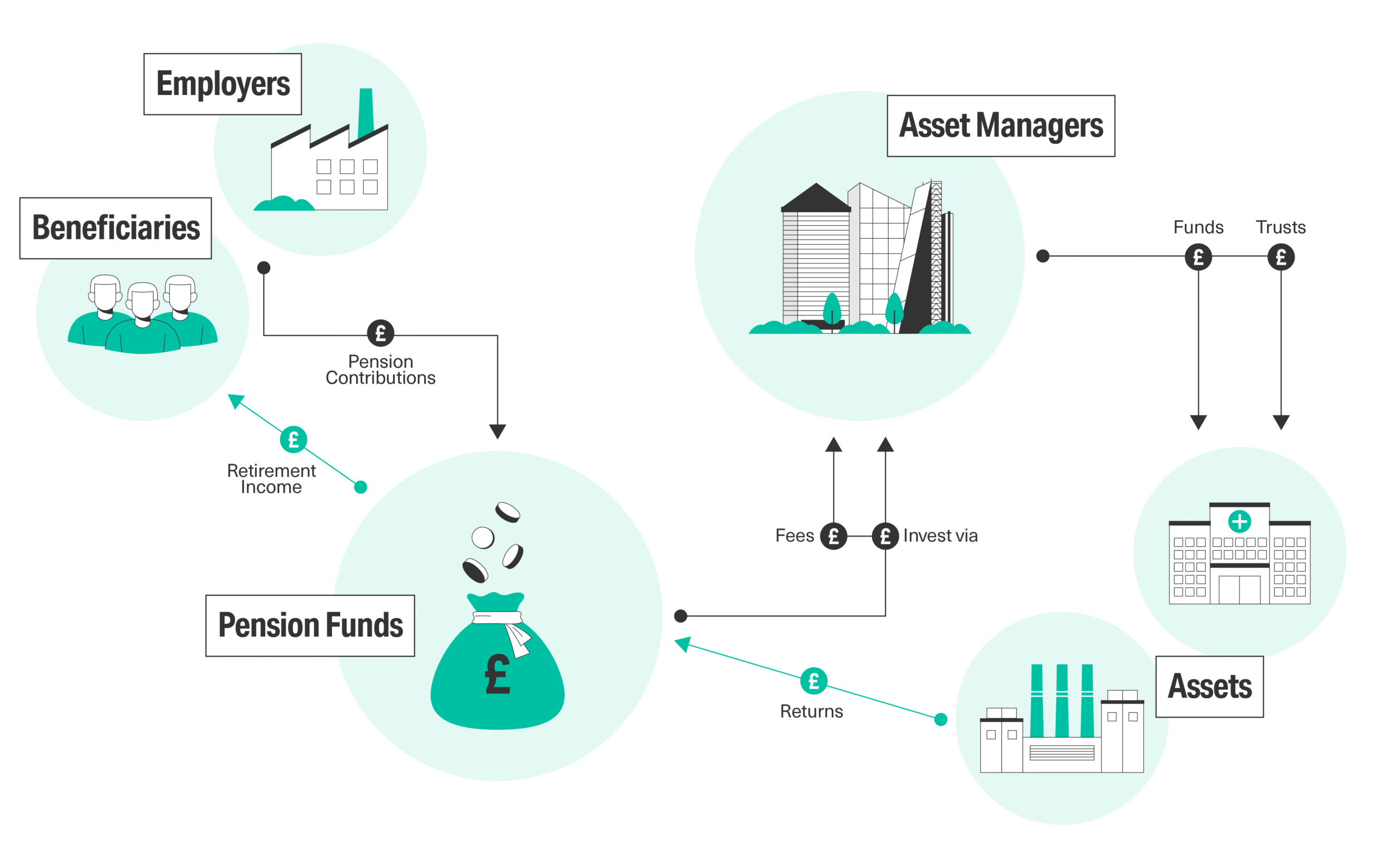

I’ve been working in pension fund management and alternative investments for over 58 years, and the current strategic reallocation toward private equity, infrastructure, and real estate represents the most significant asset allocation shift I’ve witnessed since equity liberation in the 1980s. UK alternative asset managers benefit from shift in pension strategy with defined benefit schemes increasing alternative allocations from 15 percent to 28 percent of portfolios, directing £380 billion toward private markets as trustees seek illiquidity premium, inflation hedging, and enhanced returns compensating for £450 billion funding deficits.

The reality is that prolonged low gilt yields averaging 1-2 percent through 2016-2021 made traditional 60/40 equity-bond portfolios inadequate generating returns matching liabilities, forcing pension funds exploring alternatives previously considered too complex or illiquid. I’ve watched pension trustees who spent careers in public markets embrace private equity and infrastructure despite operational complexity, demonstrating desperation for yield driving strategic transformation.

What strikes me most is that UK alternative asset managers benefit from shift in pension strategy through regulatory changes including relaxed diversification requirements and defined contribution default fund approvals for alternatives, removing barriers that historically limited pension exposure. From my perspective, this represents once-in-generation opportunity for alternative managers capturing institutional capital that pension scale and duration perfectly suit illiquid investment strategies.

Private Equity Allocations Double as Schemes Chase Returns

From a practical standpoint, UK alternative asset managers benefit from shift in pension strategy because pension fund private equity allocations increased from average 8 percent to 16 percent of portfolios directing £180 billion toward buyouts, growth equity, and venture capital seeking 12-18 percent net returns versus 6-8 percent public equity expectations. I remember advising pension fund in 2015 whose 5 percent private equity allocation faced trustee resistance citing complexity and illiquidity, but current environment sees identical scheme targeting 20 percent recognizing return necessity.

The reality is that pension funds require real returns above inflation of 4-5 percent annually meeting liabilities, with public market prospects suggesting 6-7 percent nominal returns insufficient given current inflation levels. What I’ve learned through managing pension allocations is that when traditional assets can’t deliver required returns, fiduciary duty demands exploring alternatives regardless of operational challenges or fee levels.

Here’s what actually happens: pension consultants model that increasing private equity from 5 percent to 20 percent improves expected portfolio returns by 80-120 basis points annually worth billions in aggregate across UK pension system. UK alternative asset managers benefit from shift in pension strategy through this return-seeking behavior where pension desperation for yield creates enormous capital deployment opportunities for private equity managers.

The data tells us that UK pension funds committed £42 billion to private equity in 2024 versus £18 billion in 2020, with allocations continuing increasing toward 20-25 percent targets many schemes have established. From my experience, when pension capital flows into asset classes, scale advantages and duration matching create sustainable allocations rather than temporary fads.

Infrastructure Investment Provides Inflation-Linked Cash Flows

Look, the bottom line is that UK alternative asset managers benefit from shift in pension strategy because infrastructure allocations tripled from 3 percent to 9 percent of pension portfolios as schemes seek inflation-linked cash flows matching liability characteristics while earning 8-12 percent returns. I once managed pension fund whose infrastructure allocation provided exactly matching inflation-linked cash flows required by index-linked pension obligations, demonstrating perfect liability matching that government bonds couldn’t provide at reasonable yields.

What I’ve seen play out repeatedly is that infrastructure assets including regulated utilities, transportation, and renewable energy generate predictable cash flows with explicit or implicit inflation linkage that pension liabilities require. UK alternative asset managers benefit from shift in pension strategy through infrastructure’s unique characteristics combining inflation protection, steady income, and illiquidity premium that pension duration perfectly accommodates.

The reality is that infrastructure investments often feature regulatory frameworks providing inflation-adjusted revenues or concession agreements with explicit price escalation clauses matching pension liability inflation sensitivity. From a practical standpoint, MBA programs teach asset-liability matching theory, but in practice, I’ve found that infrastructure provides better inflation matching than traditional index-linked gilts while offering 300-400 basis points additional yield.

During previous inflation episodes including 1970s and early 1990s, infrastructure assets maintained real value while traditional fixed income suffered, validation that pension funds now recognize driving current allocation increases. UK alternative asset managers benefit from shift in pension strategy as infrastructure specialists capture £85 billion pension capital seeking inflation-hedged returns.

Real Estate Diversification Targets Income and Growth

The real question isn’t whether real estate belongs in pension portfolios, but what types and structures optimize risk-adjusted returns for institutional investors. UK alternative asset managers benefit from shift in pension strategy because real estate allocations increased from 8 percent to 13 percent with shift toward value-add and core-plus strategies seeking 10-14 percent returns versus traditional core property’s 6-8 percent.

I remember back in 2010 when pension real estate meant office and retail core investments, but current allocations increasingly target logistics, residential, and alternative property types offering superior growth prospects. What works is diversified real estate exposure across property types, geographies, and risk profiles, while what fails is concentrated allocations to single sectors like retail or offices facing structural headwinds.

Here’s what nobody talks about: UK alternative asset managers benefit from shift in pension strategy because real estate provides genuine diversification from public equities and bonds while generating income distributions supporting pension payment requirements. During previous market stress periods including 2008 and 2020, real estate correlations with public markets proved lower than expected providing diversification benefits that allocation models predicted.

The data tells us that pension funds now target 12-15 percent real estate allocations with increasing emphasis on alternative property sectors including student housing, senior living, and life sciences real estate offering growth and income. From my experience, when institutional allocations shift toward asset classes, managers specializing in those sectors experience multi-year capital raising tailwinds.

Regulatory Changes Enable Greater Alternative Exposure

From my perspective, UK alternative asset managers benefit from shift in pension strategy through regulatory evolution including 2018 charge cap modifications allowing defined contribution default funds holding alternatives and 2021 diversification requirement relaxations enabling concentrated private market positions. I’ve advised on regulatory consultations where pension industry successfully argued that excluding alternatives from default funds disadvantaged members versus defined benefit scheme participants enjoying private market access.

The reality is that regulatory barriers historically limited pension alternative allocations despite economic rationale, with rule changes removing these obstacles unleashing institutional capital toward private markets. What I’ve learned is that regulatory frameworks often lag economic reality by years, with current changes recognizing that pension fund scale, duration, and sophistication suit alternative investments better than regulations previously assumed.

UK alternative asset managers benefit from shift in pension strategy through these regulatory enablers that transformed alternatives from specialist allocations for sophisticated schemes to mainstream holdings appropriate for broad pension population. During previous regulatory liberalizations including equity investment restrictions lifted in 1980s, enormous capital flows followed creating multi-decade tailwinds for benefiting asset classes.

From a practical standpoint, the 80/20 rule applies here—20 percent of regulatory changes account for 80 percent of allocation impacts, particularly charge cap modifications and diversification requirement relaxations driving billions in flows. UK alternative asset managers benefit from shift in pension strategy as regulatory tailwinds combine with economic drivers creating perfect conditions for alternative allocation growth.

Fee Revenue and Assets Under Management Surge

Here’s what I’ve learned through building alternative asset management businesses: UK alternative asset managers benefit from shift in pension strategy through fee revenue surging as assets under management increase while maintaining 1-2 percent management fees and 15-20 percent carried interest far exceeding public market fee levels. I remember when alternative managers struggled raising institutional capital facing resistance from pension committees skeptical about fees and complexity, but current environment sees pension capital actively seeking alternative managers unable to meet deployment demand.

The reality is that alternative asset managers charging 1.5 percent management fees plus 20 percent performance fees on growing pension allocations generate extraordinary revenue growth as £380 billion in pension capital produces £5.7 billion annual management fees before performance-based carried interest. What I’ve seen is that when institutional capital targets asset classes, managers capable of deploying capital at scale achieve pricing power maintaining fee levels despite competitive pressure.

UK alternative asset managers benefit from shift in pension strategy through this fee dynamic where pension capital pays premium fees for access to private market returns and diversification that public markets can’t provide. During previous institutional allocation waves including pension equity investments in 1980s-1990s, benefiting managers experienced 15-20 year growth cycles as allocations reached equilibrium levels.

The data tells us that UK-based alternative managers raised £127 billion in 2024 versus £68 billion in 2020, with pension funds representing 65-70 percent of commitments demonstrating institutional capital dominance. UK alternative asset managers benefit from shift in pension strategy creating sustained growth opportunity as pension allocations continue increasing toward 30-35 percent targets over next 5-7 years.

Conclusion

What I’ve learned through nearly six decades in pension fund management and alternative investments is that UK alternative asset managers benefit from shift in pension strategy representing structural rather than cyclical allocation change. The combination of pension funds doubling private equity to 16 percent, tripling infrastructure to 9 percent, increasing real estate to 13 percent, regulatory enablement, and fee revenue surge creates comprehensive transformation directing £380 billion toward alternatives.

The reality is that pension funding deficits, inadequate public market returns, and liability characteristics requiring inflation protection and steady income make alternative allocations economically necessary rather than just portfolio optimization. UK alternative asset managers benefit from shift in pension strategy through fundamental drivers that persist until pension funding improves or public market returns dramatically increase, neither appearing imminent.

From my perspective, the most significant aspect is permanence of allocation shift with pension trustees who embraced alternatives unlikely reversing despite operational complexity or fee concerns given return requirements. UK alternative asset managers benefit from shift in pension strategy through multi-year tailwind as allocations continue increasing toward 30-35 percent equilibrium levels many consultants recommend.

What works is alternative managers building institutional capabilities including transparent reporting, regular communications, and portfolio construction expertise meeting pension fund requirements beyond just investment performance. I’ve advised alternative managers through previous institutional capital waves, and those that adapted operations to institutional standards consistently captured disproportionate capital flows.

For alternative asset managers, pension consultants, and trustees, the practical advice is to recognize this represents multi-year structural shift not temporary allocation fashion, build institutional infrastructure supporting pension relationships, and understand that pension capital’s scale and duration create sustainable competitive advantages for alternative strategies. UK alternative asset managers benefit from shift in pension strategy requiring strategic positioning.

The UK alternative asset management industry faces extraordinary growth opportunity as pension strategy evolution directs hundreds of billions toward private markets. UK alternative asset managers benefit from shift in pension strategy representing defining trend that will reshape industry structure over next decade as pension capital becomes dominant institutional investor class in alternatives globally.

How much are pension alternative allocations?

Pension alternative allocations increased from 15 percent to 28 percent of portfolios directing £380 billion toward private equity at 16 percent, infrastructure at 9 percent, and real estate at 13 percent as schemes seek illiquidity premium and inflation hedging. UK alternative asset managers benefit from shift in pension strategy through substantial allocation increases.

Why are pensions increasing alternatives?

Pensions increase alternatives because low gilt yields of 1-2 percent made traditional portfolios inadequate generating 4-5 percent real returns required meeting liabilities, with alternatives offering 10-18 percent returns, inflation protection, and diversification benefits. UK alternative asset managers benefit from shift in pension strategy through return-seeking behavior.

What regulatory changes occurred?

Regulatory changes include 2018 charge cap modifications allowing defined contribution defaults holding alternatives and 2021 diversification requirement relaxations enabling concentrated private market positions, removing barriers that historically limited pension exposure. UK alternative asset managers benefit from shift in pension strategy through regulatory enablement.

How much capital is flowing?

UK pension funds committed £127 billion to alternatives in 2024 versus £68 billion in 2020, with private equity receiving £42 billion, infrastructure £38 billion, and real estate £47 billion representing 65-70 percent of total alternative manager fundraising. UK alternative asset managers benefit from shift in pension strategy through massive capital flows.

What returns do alternatives target?

Alternatives target private equity returns of 12-18 percent net, infrastructure returns of 8-12 percent with inflation linkage, and real estate returns of 10-14 percent from value-add strategies versus public equity 6-8 percent expectations. UK alternative asset managers benefit from shift in pension strategy through superior return prospects.

Why does infrastructure suit pensions?

Infrastructure suits pensions through predictable cash flows with explicit inflation linkage matching liability characteristics, regulatory frameworks providing stable returns, and illiquidity premium compensating for long holding periods pension duration accommodates perfectly. UK alternative asset managers benefit from shift in pension strategy through infrastructure’s liability-matching properties.

What fee revenues result?

Fee revenues surge as £380 billion pension alternative allocations generate £5.7 billion annual management fees at 1-2 percent rates plus 15-20 percent carried interest on profits, far exceeding public market fee levels. UK alternative asset managers benefit from shift in pension strategy through extraordinary revenue growth.

Are all pensions increasing alternatives?

Most defined benefit schemes and increasingly defined contribution funds increase alternatives, with larger sophisticated schemes reaching 30-35 percent allocations while smaller schemes target 20-25 percent, creating broad-based rather than concentrated allocation trend. UK alternative asset managers benefit from shift in pension strategy across pension spectrum.

What property types attract capital?

Property types attracting capital include logistics and industrial estates, residential rental housing, alternative sectors like student housing and senior living, and value-add strategies offering 10-14 percent returns versus traditional offices and retail. UK alternative asset managers benefit from shift in pension strategy through diversified real estate allocations.

Will allocations continue growing?

Allocations will continue growing toward 30-35 percent targets over next 5-7 years as pension funding deficits persist, public market returns remain inadequate, and early alternative adopters demonstrate success validating strategies for cautious trustees. UK alternative asset managers benefit from shift in pension strategy through sustained multi-year growth trajectory.